15 Best Income Generating Assets to Invest In: How to Secure Your Financial Future

With an uncertain economic climate, investing in ‘Income Generating Assets’ offers a beacon of financial stability and promise. The statistics are startling: over 1/3 (one-third) of Americans have no retirement savings or assets at all, and of those who do save, many have less than $5,000 put away which is not enough amount for living. This shows that alternative strategies are needed. One strategy is investing in income-producing assets that can generate a steady stream of cash flow. Assets like real estate properties and dividend stocks are common options. Real estate investments like rental homes or apartment buildings produce monthly income from tenants. Investing in a mix of income generating assets as part of a diversified portfolio can really add up over time, supplementing other retirement savings strategies.

What are Income Producing Assets?

Income producing assets are investments that produce a consistent flow of revenue for investors. These assets encompass various forms, including equities, fixed-income securities, properties, and diverse investment vehicles. The key objective behind allocating funds to income generating assets is to establish a residual income stream capable of supplementing or substituting active earnings. This approach proves especially advantageous for individuals seeking financial autonomy, including retirees or those aspiring to attain economic self-reliance.

Among the variety of assets that might generate income, rental homes stand out as a popular option. This is buying a property and renting it to tenants in order to provide a steady stream of rental revenue. It’s important to remember that owning rental properties does have its share of difficulties, such as property management duties and related maintenance and upkeep charges.

Top 15 Income Generating Assets for Financial Freedom

Let’s explore the 15 top income-producing assets you may use to safeguard your finances and create a reliable passive income stream. There are several paths to choose when it comes to increasing wealth and creating money. A wide variety of assets can provide special advantages and factors, from tried-and-true choices like real estate investments and dividend-paying equities to more unusual choices like peer-to-peer lending and fine art. It’s critical to choose investments that match your financial goals, risk tolerance, and personal preferences. Let’s set out on a path of financial empowerment together, discovering the sources of income that can pave the way for your financial success.

Read Also: How To Make A Budget

- Real Estate Investments

- Dividend-Paying Stocks

- Bonds

- Peer-to-Peer Lending

- High-Yield Savings Accounts

- Rental Properties

- Stock Market Index Funds

- Rental Real Estate Investment Trusts (REITs)

- Certificate of Deposits (CDs)

- Royalty-Based Investments

- Annuities

- Fine Art

- Rental Storage Units

- High-Yield Dividend Stocks

- Digital Products

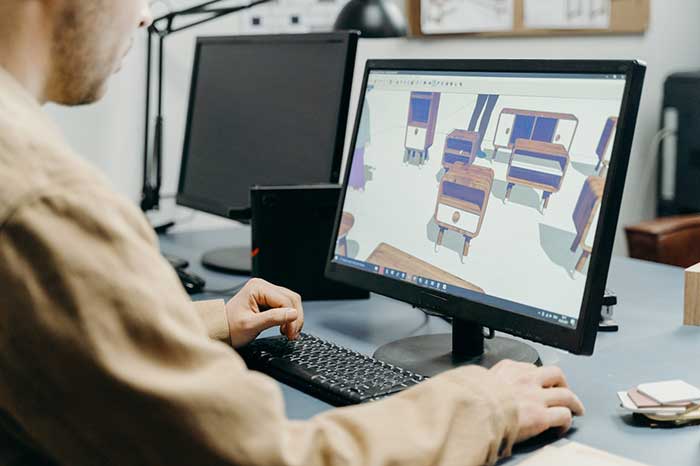

1. Real Estate Investments

Real estate investments have always been regarded as a dependable and passive income-generating avenue, maintaining their position as one of the most favored assets for income generation. The acquisition of properties such as rental homes, commercial spaces, or real estate investment trusts (REITs) presents an opportunity to derive a steady rental income. Rental properties possess the advantage of a consistent cash flow, with tenants providing rent payments for occupancy. This reliable income stream proves beneficial in covering mortgage payments, and property upkeep and even allows for surplus funds to be allocated toward additional investments.

Also Read:

Is Real Estate Investment Trusts A Good Career Path?

How Many Jobs Are Available In Real Estate Investment Trusts?

2. Dividend-Paying Stocks

Investing in dividend-paying stocks is another excellent option for income generation. By purchasing shares in well-established companies that regularly distribute dividends, you can earn a steady income stream. It is important to conduct thorough research and choose stocks from reliable companies with a strong track record of consistent dividends.

3. Bonds:

Fixed-income securities attract individuals looking for a stable revenue source. Diverse types of these monetary instruments exist, such as businesses, local authorities, and state-issued securities. In contrast to equities, fixed-income securities are perceived as having a lower risk profile and are well-regarded for generating regular and dependable cash flows. Those who possess these revenue-generating holdings can benefit from ongoing interest disbursements throughout their fiscal endeavors.

4. Peer-to-Peer Lending:

Peer-to-peer lending has grown in acceptance as a desirable substitute for investors looking for varied alternatives. These online platforms connect individuals and small businesses, enabling direct lending and the potential to earn attractive interest rates on invested capital. By participating in peer-to-peer lending, investors can explore avenues beyond traditional savings accounts and aim for potentially higher returns while diversifying their investment portfolios.

5. High-Yield Savings Accounts:

Often underestimated, high-yield savings accounts present an excellent opportunity for individuals seeking a secure and dependable means of generating income. These accounts offer interest rates that surpass those of traditional savings accounts, allowing your wealth to grow steadily over time.

6. Rental Properties:

Investing in properties for rental purposes can prove highly profitable, offering a consistent monthly income stream. However, it’s crucial to carefully consider factors such as location, property management, and market demand before venturing into the rental property market.

7. Stock Market Index Funds:

Stock market index funds are a desirable option for those who like a hands-off investment strategy. These investments seek to mimic the performance of particular stock market indices, like the S&P 500. You can expose yourself to a diverse array of equities and profit from market expansion by investing in index funds.

8. Invest in Real Estate Investment Trusts (REITs):

A REIT is a company that owns and typically operates income-producing real estate or related assets. Real Estate Investment Trusts are well known for efficiently managing different types of properties and generating consistent revenue and adding it to the savings. By investing in REITs, people can acquire ownership stakes for revenue and receive direct payouts from the rental earnings created by the trust’s real estate holdings. This investment approach offers a distinctive chance to engage in the property market, bypassing the challenges associated with property upkeep.

9. Certificate of Deposits (CDs):

Certificates of Deposits (CDs) represent safe, time-bound investment options provided by banking institutions and cooperative financial organizations. When investing in CDs, you commit to maintaining your funds deposited for a specified duration, and in exchange, you obtain a pre-established interest rate. CDs are considered low-risk investments, delivering a dependable income stream.

10. Royalty-Based Investments:

Royalty-based investments offer an opportunity to earn income from creative works, such as music, films, books, or patents. By investing in royalties, you become a stakeholder in the intellectual property and receive a portion of the revenue generated from its usage or sales. This can be a profitable asset class, especially if you identify promising artists or innovative products with the potential for widespread popularity.

11. Annuities:

Those alluring financial products known as annuities are a favorite among people looking for security and stability throughout their retirement years. You may relax knowing that your hard-earned money is being wisely invested thanks to annuities. You can choose to make a one-time payment or opt for multiple payments by establishing a tactical agreement with an insurance company. In return, you will gain a consistent flow of earnings that can last for a prolonged duration, potentially spanning your entire lifetime. Having this steady stream of income will let you relax throughout your well-earned retirement years.

12. Fine Art:

Investing in fine art can be a unique income generating asset. Collecting and investing in artwork by renowned artists can yield substantial returns over time. The value of art often appreciates, and you can generate income by selling the artwork or renting it out for exhibitions.

13. Rental Storage Units:

Investing in rental storage units can be a profitable venture and an alternative income generating asset. With the increasing demand for storage space, purchasing storage units and renting them out to individuals or businesses can generate a consistent income stream. People often need extra storage for personal belongings, seasonal items, or even business inventory. By investing in rental storage units, you provide a valuable service to those in need while also earning passive income.

14. High-Yield Dividend Stocks:

Allocating funds to high-yield dividend stocks can be a desirable strategy for generating income. These stocks provide elevated dividend yields in comparison to the typical market yield. However, it is crucial to carefully evaluate the financial health and stability of the companies before investing, as higher yields can sometimes indicate higher risks.

15. Digital Products:

Making and selling digital goods can be a successful source of revenue in the digital era. E-books, online classes, software, and other digital assets fall under this category. These goods can produce passive income after they are developed since they can be sold repeatedly without adding to the cost of manufacturing.

Conclusion:

Investing in various assets to ensure a stable financial future is a prudent approach. Whether your preference lies in real estate, stocks with dividend payouts, peer-to-peer lending, or even the world of fine art, the key lies in diversifying your investment portfolio to mitigate risks effectively. It is imperative to engage in comprehensive research, evaluate your risk tolerance, and seek expert guidance if necessary. By making wise investment decisions in these income-generating assets, you pave the way towards accumulating wealth, attaining passive income, and ultimately realizing your financial aspirations.

Read More: Best Businesses To Start In Florida

news via inbox

Sign up and never miss out on the latest news and updates at HighStuff